We understand Australian Fringe Benefits Tax rules can be complex. This year there is an added layer of intricacy as the Australian Tax Office (ATO) has released a number of concessions and rulings in response to the changed work environment over the past 12 months.

Our team of corporate tax experts have designed the 2021 Fringe Benefits Tax Guide to give you a handy reference point as you navigate this year’s Fringe Benefits Tax process. If you have any questions, please contact our team directly for clarification.

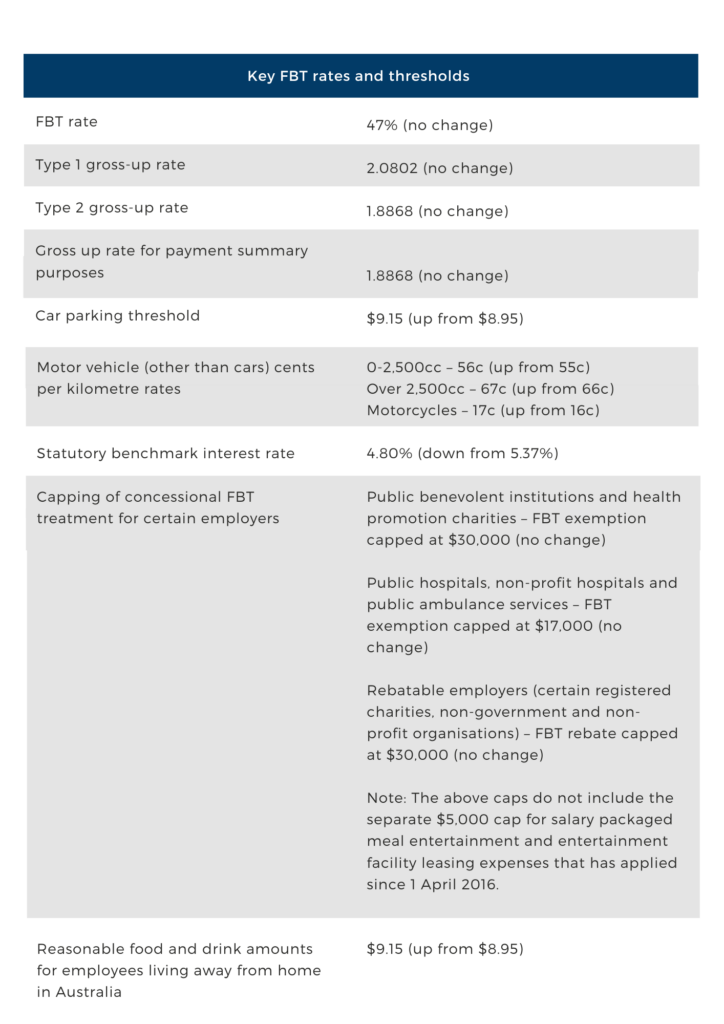

1. Key Fringe Benefits Tax rates and thresholds

The following rates and thresholds apply for the Fringe Benefits Tax year 1 April 2020 to 31 March 2021 (2021 FBT year):

2. COVID-19 related Fringe Benefits Tax concessions

In response of the COVID-19 situation, there are many rulings issued to alleviate the burden of business from Fringe Benefits Tax liabilities and clarify the treatment of certain benefits. They include the following.

A. Travel related benefit

The following draft rulings have been issued to assist the taxpayer in classifying whether the travel related benefits incurred is for work related and therefore could be exempted from the Fringe Benefits Tax: –

- Draft Taxation Ruling TR 2021/D1 and Draft Practical Compliance Guidelines PCG 2021/D1 on meal and accommodation.

- Taxation Ruling TR 2021/1 on transport expenses

Meal and Accommodation Expenses

Generally, the employee’s accommodation, meal and incidentals are considered private in nature and not deductible. However, where the accommodation and meal expenses are incurred as a result of travelling (overnight) for work, the expenses will be considered as income-producing purpose and be deductible under s8-1 of ITAA 1997.

There are several types of the work travel, such as whether the employee is considered travelling (overnight) for work, or Living Away from Home (LAFH) arrangement or relocated to a new workplace. Depending on the type of the travels, different Fringe Benefits Tax concessions may apply as follows: –

- Travelling (overnight) for work: expenditure can be reduced through ‘otherwise deductible rule’.

- LAFH: may not be deductible under ‘otherwise deductible rule’ however Fringe Benefits Tax concession under s30 may be available.

- Relocated: may not be deductible under ‘otherwise deductible rule’ however some limited Fringe Benefits Tax concession may be available.

PCG 2021/D1 has provided the ‘rule of thumb’ on the criteria of travelling (overnight) for work. One of the most important factors to take into consideration when the employee is away from the normal residence for work purpose for the period less than 21 days continuously and the total travel period is less than 90 days for the same work location during the same FBT year. If these criteria are met, it is likely that that the travel expenses can be considered incurred for travelling (overnight) for work and deductible for Fringe Benefits Tax purpose.

Please note that the PCG 2021/D1 should be used as a guidance and not a definitive ruling. Therefore, it is necessary for the whole circumstances to be assessed thoroughly to determine whether the travel is considered travelling (overnight) for work. The ATO has suggested that the TR 2021/D1 and PCG 2021/D1 are to be observed in conjunction with each other.

Transport related expenses

The analysis for the transport expenses and accommodation and meal expenses should be done separately as each benefit may have different tax treatment under Fringe Benefits Tax Guide regime.

It is generally accepted that the travel to work (between home and regular workplace) is not deductible. However, the TR2021/1 outlines some exceptions to this general rule and allows the transport expense to be deductible using the ‘otherwise deductible rule’.

One of the common scenarios where the employees required to work concurrently at two or more geographically distant workplace for the same employer, the cost of transport to another workplace is deductible under ‘otherwise deductible rule’ if the overnight stay is required, the transport expense is incurred due to practical demands of carrying out of work duties and not by employee’s choice.

B. Car benefit

To provide a general overview of what constitutes a ‘car benefit’, for Fringe Benefits Tax purposes it is a vehicle with a carrying capacity less than 1 tonne that is designed to carry fewer than 9 passengers. To be deemed a ‘car fringe benefit’ the vehicle must be ‘held’ by an employer. A car is held by an employer when they either own the car, lease the car or otherwise make the car available to an employee.

Notwithstanding the above, for a car fringe benefit to arise the vehicle must be used or deemed available to be used for the private use of an employee. It is critical to note that this can include the car being kept at the place of residence of an employee, kept at a place other than the business premises where the employee can use it for private purposes and any situation where the car is off business premises and the employee has control of the car and is using it for reasons outside their employment.

Should the above conditions be met, the employer is providing a car fringe benefit and can access the specific concessional valuation rules – Statutory formula method & Operating cost method. Indeed, the Statutory formula method is the common option adopted as the Operating cost method requires employees to maintain a 12-week logbook. Furthermore, when private usage is high, the latter method tends to produce a higher taxable value.

Cars stored at the employee’s home during lockdown of COVID-19

In terms of the new concession, the COVID-19 induced lockdowns saw many employers provided cars stored at home for extended periods for safety purposes. As a result, the ATO has revealed that an employer does not hold a car for the purposes of providing fringe benefits to an employee (subject to certain conditions) when it is stored at an employee’s home and not driven as a result of COVID-19.

To gain access to this concession, employers must satisfy the following conditions:

- Operating cost method must be used to value any car fringe benefits that arise in relation to the car during the Fringe Benefits Tax year.

- The employer must elect in writing to use the operating cost method.

- The car was stored at the employees’ home for all or part of the Fringe Benefits Tax year.

- During the period the car was in ‘storage’ at the employees’ home, it was not driven at all or was only driven briefly for maintenance purposes.

- Odometer records must be maintained as evidence.

Ultimately, many employers will be forced to alter their valuation method to the operating cost method as it is a mandatory requirement to access this concession.

C. Car parking benefit

Section39A of the Fringe Benefits Assessment Act 1986 (FBT Act) sets out the conditions for a car parking benefit to arise. One of the conditions require a commercial parking station to be located within a one-kilometre radius of the work car park used by an employee.

For a parking facility to be considered a “commercial parking station”, it must provide all-day parking in the ordinary course of its business to members of the public and charge a fee. The facility must be permanent in nature, not a metered parking on a street or road.

Under the new ruling, the ATO has reversed its previous position and clarified that car park that allows all day parking but charges a penalty or high fees to discourage all day parking can still be considered a commercial parking station for FBT purposes. A new ruling TR 2019/D5 was issued as a result of the outcome of the Qantas Case and the Virgin Blue case.

As a result of the new ruling, car parking facilities located at shopping centres, hospitals, hotels, universities and airports may now be considered commercial parking stations if the car parking charge rate is above the car parking threshold (the rate for 2021 FBT year is $9.15).

The change of the ATO interpretation will mainly affect employers who are in suburban areas. Employers may potentially be required to pay FBT on car parking benefits provided to employees if there is shopping centre or hospital located within a one-kilometre area of the car parking facility provided to employees.

This new rule will start on 1 April 2022 (i.e. the 2023 FBT year). Affected employers should review the current car parking benefit arrangement and employees’ remuneration packages (e.g. to determine if they should be paying an allowance which will be subject to PAYG Withholding rules instead of providing a car parking benefit to avoid FBT exposure).

D. Meal and Entertainment Benefits

One of the issues discussed in the FBT factsheet (QC 63467) is regarding whether the cancelled events may trigger any FBT liabilities for the employer.

Generally, there is no benefit provided to the employees until the benefit is consumed. In the situation where the event booked by the employer was cancelled due to the COVID-19 situation, the employer would not constitute to have provided any benefits to the employees as the benefits are yet to be consumed by the employees.

However, please note that there is no Fringe Benefits Tax liability on the non-refundable expenses paid for the cancelled event if the arrangement is between the employer and the organisers directly and the employer has not provided any other benefits (such as reimbursing the employees for the attendance fees) due to the cancelled event.

The employer needs to note further that income tax deduction and Goods and Services Tax (GST) input tax credit are not available for meal entertainment expenses unless the expenses are subject to Fringe Benefits Tax.

Alternatively, the employer may provide meal and entertainment benefit to the employees through different channel such as providing hampers or movie vouchers. The minor benefit exemption could potentially apply to reduce the taxable value of these benefits.

The minor benefit exemption criteria will be the provision of the benefit is less than $300, it is irregular or infrequent and it is not compensation for employees’ services. The assessment for the exemption is made on per item per employee per FBT year and not based on the aggregate value. For example, the employer provided a hamper worth $250 and a $100 movie voucher to an employee, the exemption will be assessed on hamper and voucher separately not on the total $350 value of the benefits provided.

3. Additional Fringe Benefits Tax concession extensions

The ATO has extended the Fringe Benefits Tax concession towards the following benefits during the COVID-19 situation: –

Emergency assistance for employees during COVID-19

Generally, benefits provided by the employer in response to the emergency assistance are exempt from Fringe Benefits Tax. The ATO has confirmed that COVID-19 is considered an ‘emergency’ and accordingly assistance given by employers to provide relief to someone that is or is at risk of being adversely affected by COVID-19 has potential to be exempt from FBT.

Briefly, section 58N outlined that a benefit will be an exempted from Fringe Benefits Tax where: –

(a) a benefit is provided in respect of the employment of an employee of an employer; and

(b) the benefit is provided solely by way of the grant of emergency assistance to the recipient of the benefit.

In the ATO guide, it was stated that the emergency assistance exemption will extends to meal and accommodation provided by employer to the employees unable to return to home due to the travel restrictions, short term loan to the employee affected by COVID-19 situation and health care benefit (such as vaccinations) for employees.

Working from home benefits

In response to the COVID-19 situation, the employers often provide some office equipment and portable electronic devices to their employees to work from home. The provision of these benefits could potentially raise the employer’s Fringe Benefits Tax liability.

- Provision of office equipment (other than portable electronic devices)

When the employer provides office equipment such as desk and chair while the employee is working from home, this benefit will consider to be residual benefits. This residual benefit could be exempted from FBT using the exemption under S47(3), which applies for provision of property commonly used / located in business premises and connected to business operation.

For example, the employer purchased desk and send it to the employee’s home due to the working from home arrangement. Once the arrangement is over, the desk will be required to be returned to the office for the employer to be exempted from FBT. However, if the desk is not returned to the office at the end of the arrangement, then the desk will be considered as a residual benefit provided by employer and subject to Fringe Benefits Tax.

There other concessions may be applicable for the employer to be exempted from the FBT such as S58P on minor benefit exemption and S52 on ‘otherwise deductible rule’

Please note that if the employer decides to give the employee the equipment (property benefit) or reimburse the employee for the expense in purchasing the equipment (expense payment benefit), it is highly likely the FBT liability will arise.

- Provision of portable electronic devices

S58X provides FBT exemption for eligible work-related item (including portable electronic device) provided in expense payment benefit, property benefit or residual benefit forms. The employer can only be exempted from FBT on one portable electronic device per FBT year if the later device has substantially identical functions to the earlier device. However, this prohibition does not apply if it is replacing the old item, or the employer is a small business entity for the FBT concession.

Retraining/ reskilling staff

Generally, FBT is payable if the employer provides training to a redundant or soon to be redundant employee, especially where the training provided has no sufficient connection with the existing employment.

Under the new FBT exemption will apply from 2 October 2020 (if it is enacted), the retraining / reskilling soon to be redundant or redeployed employees will be exempt from FBT under S58M (work-related counselling).

The work-related counselling covers the ‘outplacement services’ provided by employer such as assistance in writing a resume and job application, guidance on seeking new employment, training for employment interviews and selection tests, the provision of any ancillary services in support of the primary services provided (e.g. the use the employer’s telephone or office space).

However, please note that this exemption will not apply for the benefit provided under salary packaging arrangement or Commonwealth support such as HELP or HECS.

Small business Fringe Benefits Tax exemption expanded

From 1 April 2021, the threshold for business entities to access small business concessions has substantially increased to $50 million. Previously, a business will only be eligible for the small business FBT concession if the aggregate turnover is less than $10 million (period from 1 April 2017 to 31 March 2021). Under the new threshold, a business that does not qualify as a small business entity previously could potentially qualify for the FBT concessions from 2022 FBT year.

Some of the common FBT concessions for small business are S.58X(4) which allows small business employers to provide multiple (qualifying) portable electronic devices to an employee in the same FBT year and the concession in S.58GA which provides an FBT exemption for certain car parking benefits.

Return to highlights

4. Increased ATO compliance measures

In the current FBT year, the ATO has increased the compliance measures on the following issues:

A. Substantial rule for using ‘Otherwise Deductible Rule’

Under the administrative concession, the employer could utilise the ‘otherwise deductible rule’ to reduce the taxable value of expense payment benefit up to the amount $50 per employee per FBT year without substantiation.

If the payment exceeds $50, a receipt/ invoice, a four-week representative diary and employee declaration will be required. To avoid this substantiation, it is suggested that the employer pays the employee allowance instead of reimbursing the expenses.

B. Non-cash benefit for termination employee

The provision of a gift to the terminating employee can either falls under FBT or income tax regime.

Under S82-130 Income Tax Assessment Act (ITAA) 1997, the provision of gift (transfer of property) could be categorised as part of employment termination payment if it is received by the employee as a consequence of the employment termination (other than genuine redundancy payment) within 12 months from the termination date.

The ATO has highlighted that when the provision of gift falls under employment termination payment in income tax regime, the employer will have obligation to pay the withholding amount to the ATO before providing the benefit. In addition, a PAYG Payment Summary on the employment termination payment must be provided to the employee and reported to the ATO within 14 days from provision of gift.

The employer may recover the withholding amount paid to the ATO from the employee and regardless whether or not the employer recover the withholding amount from the employee, the employee will obtain a credit for the tax paid.

you can read more on the New Corporate Tax Transparency Measures.

5. Updates on Salary Packaging Arrangement

In response to the COVID-19 situation, there are some tax incentives provided for the following salary packaging arrangement:

New ruling on employee contribution

Under the new Class Ruling CR 2020/30 for Smartgroup Corporation, the company can reduce the taxable value of car fringe benefit to NIL through the employee’s salary sacrifice arrangement.

The ATO has accepted that employee contributions received after 31 March will reduce the taxable value of the car fringe benefit of the previous FBT year if the following criteria are met: –

- The intention between the employer and employee in reducing the taxable value of the fringe benefit to NIL must be substantiated using a written agreement of the salary sacrifice arrangement (SSA).

- If the company determined any shortfall (raising the taxable value of benefit) and the difference must be recouped before the previous year FBT return is lodged.

- The SSA must be reviewed and adjusted (if required) in the subsequent year.

While the above class ruling has set a new milestone for reducing the employer’s FBT liability through SSA arrangement, it is best if the company could apply for private binding ruling rather than relying on the class ruling for Smartgroup.

Trade ins or cash contributions on novated leases

In the recent FBT factsheet on car leasing fringe benefits (QC 64594), the ATO has changed its view on scenarios where an employee trades-in their own car or makes a cash contribution towards the purchase of a car that is provided to an employee under a novated lease arrangement. These circumstances are no longer considered a bona fide lease for FBT purposes. Unfortunately, this will adversely impact employers as the benefit will be deemed a property or residual fringe benefit meaning the benefit cannot be valued under the statutory formula or operating costs methods.

Fully maintained associate lease

The ATO has confirmed the use of ‘fully maintained associate leases’ that provide lucrative tax savings. Indeed, subject to certain conditions, a fully maintained associate lease (where the associate incurs all car running expenses) can lead to tax deductions and a reduction of the employers FBT liability both arising from the running expenses incurred by the associate.

It is important to ensure that the lease between the employer and the associate is commercial (must be an arm’s length transaction) to minimise the possibility of Part IVA (provision against tax avoidance) from applying.