The Government has revised the Stage 3 Tax Cuts which were previously legislated to apply from 1 July 2024. The original Stage 3 package:

- abolished the 37% marginal tax rate for those earning more than $120,000 a year,

- reduced the 32.5% marginal tax rate to 30%, and

- increased the income threshold where the top marginal tax rate applied from $180,000 to $200,000.

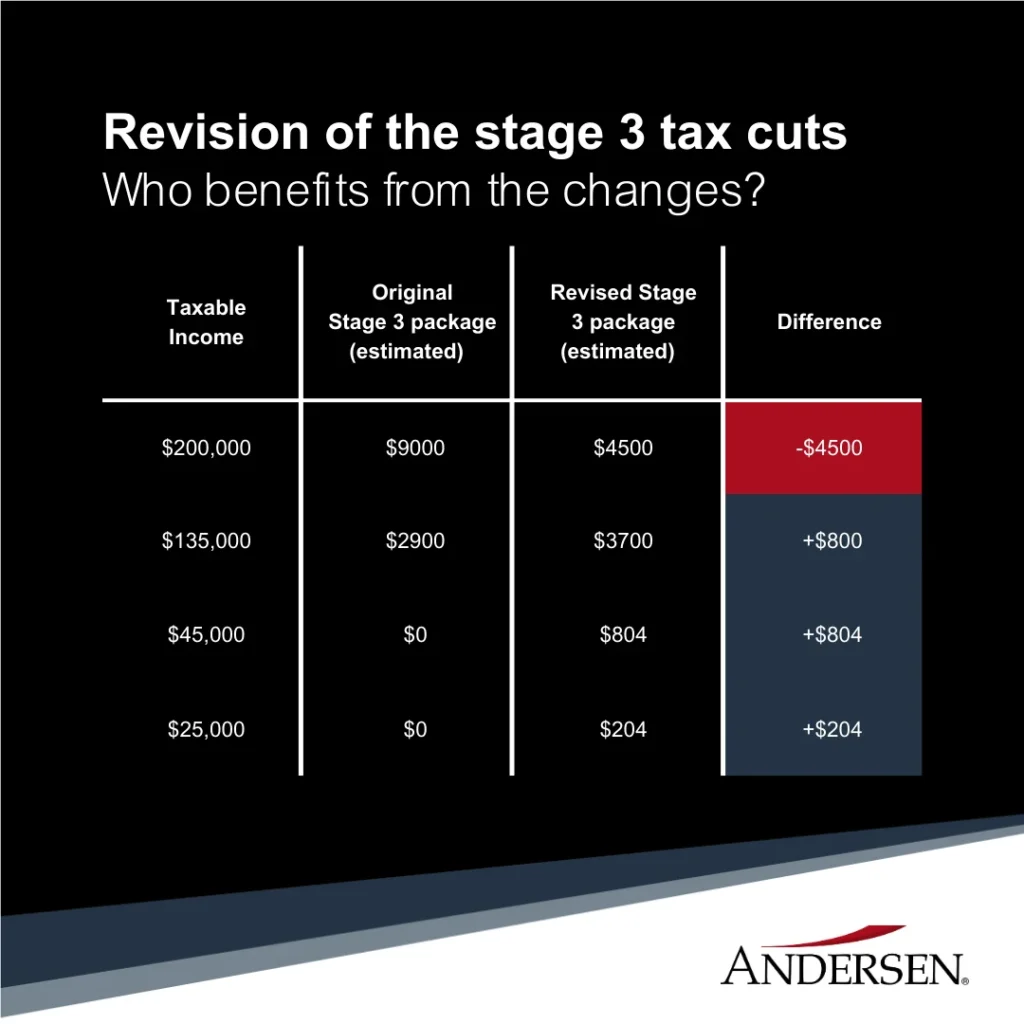

The changes meant that persons with taxable incomes between $45,000 and $200,000 would be subject to a maximum tax rate of 30%. Previous costings estimated that an individual with a taxable income of $200,000 would obtain a benefit of approximately $9000 while an individual with a taxable income of $45,000 would not benefit from the Stage 3 package. The aim of the Government in revising the Stage 3 package is to provide greater benefits to middle income earners while reducing the benefits for individuals with incomes in excess of $180,000.

From 1 July 2024, the revised Stage 3 tax package proposes to:

- reduce the 19% tax rate to 16%,

- reduce the 32.5% tax rate to 30%,

- preserve the 37% tax rate and increase the top threshold for the rate from $120,000 to $135,000, and

- increase the threshold above which the 45% tax rate applies from $180,000 to $190,000.

Who benefits from the changes?

Andersen Comment

In order to implement the revised Stage 3 package the Government will have to ensure that the amending legislation is passed by both houses of Parliament. The proposed legislation will no doubt have a “rocky” passage through Parliament and will face stiff opposition in the Senate. From a tax planning perspective, taxpayers should revisit their business and investment structures as there will now be more incentive to retain income within structures such as companies as there will be a greater difference between the lowest corporate tax rate of 25% and the marginal tax rate applying to taxable incomes up to $200,000 than previously anticipated.

For more insights and updates on navigating the revised Stage 3 Tax Cuts, Book a Chat or Consult Today