On 20 May 2025, Jaclyn Symes MP delivered her first Victorian State Budget – marking a historic moment as the state’s first female Treasurer.

The 2025–26 Budget focuses on some key priorities:

- Targeted cost-of-living relief.

- Stronger healthcare and education.

- Continued investment in essential services.

The Treasurer described this Budget as focused on “real help with the cost of living, good hospitals, great local schools, safe communities, and decent jobs.” It’s a strong message aimed at everyday concerns. But here’s the real question: did it deliver lasting, structural change to drive growth and investment?

The Numbers

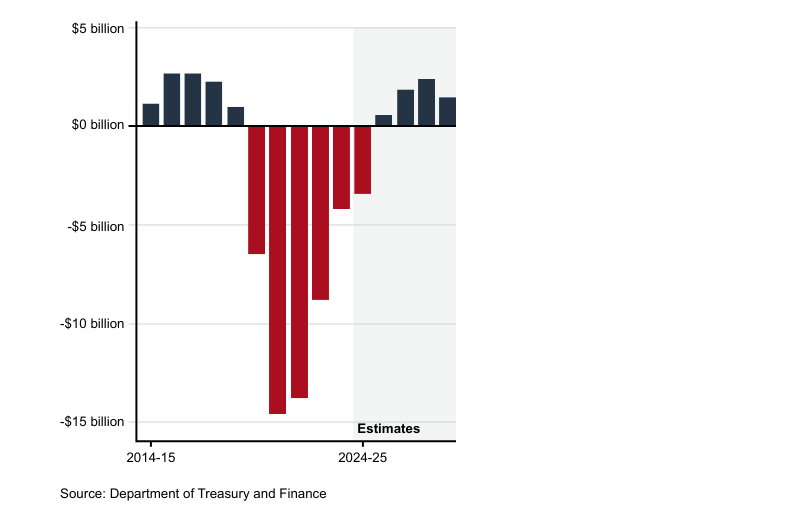

Against a backdrop of difficult National and International political and economic climates, and ballooning State Debt, the budget is to deliver a modest underlying cash surplus of $600million for 2025-26. This follows an estimated deficit of $3.4 billion in 2024-25. Future surpluses are forecast until 2028/2029, being $1.9 billion, $2.4 billion and $1.5 billion respectively each year.

Net result from transactions over time: 2025-26 budget

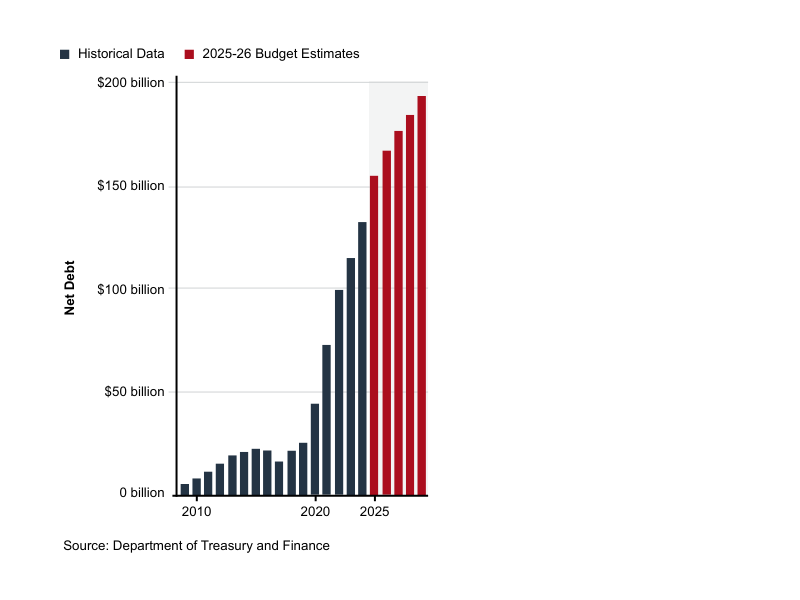

Public debt is projected to increase to 155.5 billion at 30 June 2025, with the Victorian State debt expected to reach 194 billion in 2029. With debt rising, the amount of interest being paid on this debt is expected to increase over the estimate period. In 2025-26, the interest bill is expected to be about $7.6 billion (or about 7 per cent of total government expenses), rising to $10.6 billion (9 per cent of total expenses) by 2028-29.

Net debt in Victoria over time

Key Tax Changes

No changes have been announced to the taxation of payroll tax or to other small business State tax settings. However, the Emergency Services and Volunteer Fund (the old Fire Services Levy) will double the rates paid by households.

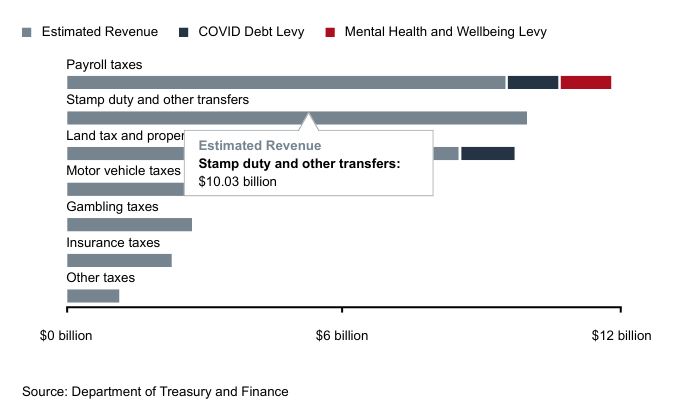

Tax revenue is expected to rise from $41.7 billion in 2025-26 to $47.9 billion in 2028-29, driven by growing revenue from land taxes, payroll taxes and stamp duty.

Expected state Government tax revenue 2025-26

Business Investment

The Budget confirms some investment in supporting Victorian business growth and investment, including:

- A new $150m Victorian Investment Fund, including $50m of this in dedicated investment for Regional Victoria.

- $35 million to deliver one-to-one advice and help more Victorians take their products to the world.

- Extending the stamp duty concession, reducing stamp duty on eligible off-the-plan homes until October 2026.

Key Revenue measures

- $4.1 billion investment in the Sunshine Station Superhub.

- $1.2 billion ‘Road Blitz’ on projects to ease congestion and improve safety and connectivity in Melbourne’s fast-growing suburbs and Victoria’s regions.

- $976 million to fix potholes, upgrade road surfaces and keep bridges and roadsides across Victoria safe.

- $850 million over four years for the Victorian prison system.

- $727 million for opening the West Gate Tunnel and Metro Tunnel.

- $412 million for the next phase of our Road Safety Action Plan.

- Public transport completely free for every Victorian under the age of 18.

- Free weekend public transport for every Seniors Card holder in Victoria.

- $400 per eligible student to support camp, sports and excursion costs.

- $100 Power Saving Bonus for households on a concession card.

Key Savings measures

The 2025-26 Budget is projected to deliver savings of $3.3 billion over the forward estimates by:

- A reduction in 1,200 full time government positions.

- Achieving better value for money in back-office costs of government departments and agencies.

- Realigning policy and program functions to reduce duplication between departments and agencies.

- Tailoring program capacity to meet demonstrated demand in the community.

Andersen Comment:

In a budget which was eagerly anticipated, and on which there were hopes of a way forward to begin to rebuild the State of Victoria, the Government has delivered a budget outlook which is largely free from any significant measures of reform, particularly in relation to tax, and is focused on cost of living relief and other measures to assist taxpayers and families with rising costs.

Whilst the Budget does contain some small measures to support businesses in Victoria, the Budget Papers show the continuing growth of tax revenue for the State over the forward estimates. Tax revenue is predicted to significantly increase by 2028-29, with the continuation of reliance placed on the increasing of land and property related taxes, as well as payroll tax and its associated levies.

Businesses may be disappointed with this Budget as it lacks any meaningful change aimed at reducing the significant tax and regulatory burden faced by Victorian business and does not include any significant incentives for new investment in the State by local or overseas investors or developers. An increase in the Emergency Services and Volunteers Fund Levy will be a further blow to business, including farmers in the current difficult drought conditions.

Given the Victorian Governments reliance on property and property related taxes, it was interesting to see limited reform in this area given recent increases in land tax for example. The increase in the Congestion Levy will do little to help what is already an uncompetitive property tax landscape in Victoria, likely to increase the high costs already being borne and risk Victoria being further uncompetitive in the National landscape. The extension of the Stamp Duty exemption for off the plan apartments until October 2026 may assist with shifting the current glut of apartments on the Victorian market, but is unlikely to promote any significant new developments. Whilst further funds have been allocated to housing in the budget, the amount of $407m seems insufficient to meet the growth aims for the population of Victoria to be equal to the population of London by 2050.

Overall, Victoria’s 2025-26 Budget outlined a mix of economic measures which are largely based on spending to assist with cost of living pressures and lacked any real measures to address the state’s pressing fiscal challenges or stimulate significant business investment. No significant reforms to key tax areas have been outlined, and the complex property tax environment continues to be a roadblock for business growth and investment.